Advice & Comments

28 Jul 2025

The US and Japan announced a broad trade agreement on Tuesday that lowers tariffs on Japanese exports,

Trade Breakthrough and Mixed Economic Signals

The US and Japan announced a broad trade agreement on Tuesday that lowers tariffs on Japanese exports, including autos, from 25% to 15%, while granting tariff-free access for US goods into Japan. As part of the deal, Japan committed to $550 billion in equity, loans, and loan guarantees to support US-bound investment - a component Treasury Secretary Scott Bessent described as central to the pact. Japan also agreed to open its market to US vehicles, agricultural products, Boeing aircraft, and defence exports. Notably, the 50% tariff on Japanese steel remains in place.

President Trump renewed criticism of Federal Reserve Chair Jerome Powell, accusing the Fed of keeping interest rates elevated for political reasons and calling the Fed board “lacking in courage.” During a contentious visit to the Fed’s Washington headquarters - amid scrutiny over costly renovations - Powell appeared visibly uncomfortable. Trump later said he did not see removing Powell as necessary. Meanwhile, Treasury Secretary Bessent called for a systemic review of the Fed’s governance amid ongoing controversy.

Economic data offered a mixed picture. S&P Global’s flash PMI for July showed private sector growth accelerating to a seven-month high of 54.6, driven by a strong services sector (55.2). Manufacturing, however, contracted, dropping to 49.5`the lowest since December.

Policy Pause Amid Cautious Optimism

At it’s 24 July meeting, the European Central Bank held its deposit rate steady at 2.0% after eight consecutive cuts since June 2024. ECB President Christine Lagarde highlighted persistent global uncertainties, particularly trade tensions, as justification for a cautious “wait-and-see” stance. Meanwhile, Eurozone business activity improved modestly, with the HCOB flash composite PMI rising to 51.0 in July from 50.6, supported by gains in both services and manufacturing.

In the UK, retail sales rose 0.9% in June, rebounding from a steep May decline. Despite warmer weather, consumer demand remained subdued. The July flash composite PMI also edged down to 51.0 from 52.0 as services weakened and employment indicators signalled labour market strain, pressured by higher payroll taxes and ongoing trade frictions.

In Europe, the pan-European STOXX Europe 50 slipped -0.13% (local currency), as optimism around a potential EU-U.S. trade deal was tempered by warnings of possible retaliatory tariffs. Meanwhile, the UK’s FTSE 100 rose 1.43%

Trade Deals Boost Markets Despite Inflation and Political Risk

Tokyo’s core CPI rose 2.9% year-on-year in July, slightly below expectations and down from June’s 3.1%. Despite easing, inflation remains above the Bank of Japan’s 2% target. With reduced uncertainty following the trade deal, investor expectations are shifting toward another BoJ rate hike later this year.

U.S. Treasury Secretary Scott Bessent is scheduled to meet Chinese officials in Stockholm last week for a third round of talks aimed at extending the current trade deal expiring in August. Previous discussions in Geneva and London led to a temporary tariff pause and eased export controls. Though tensions persist after April’s 145% U.S. tariff hike on Chinese imports, talks have eased fears of a complete decoupling.

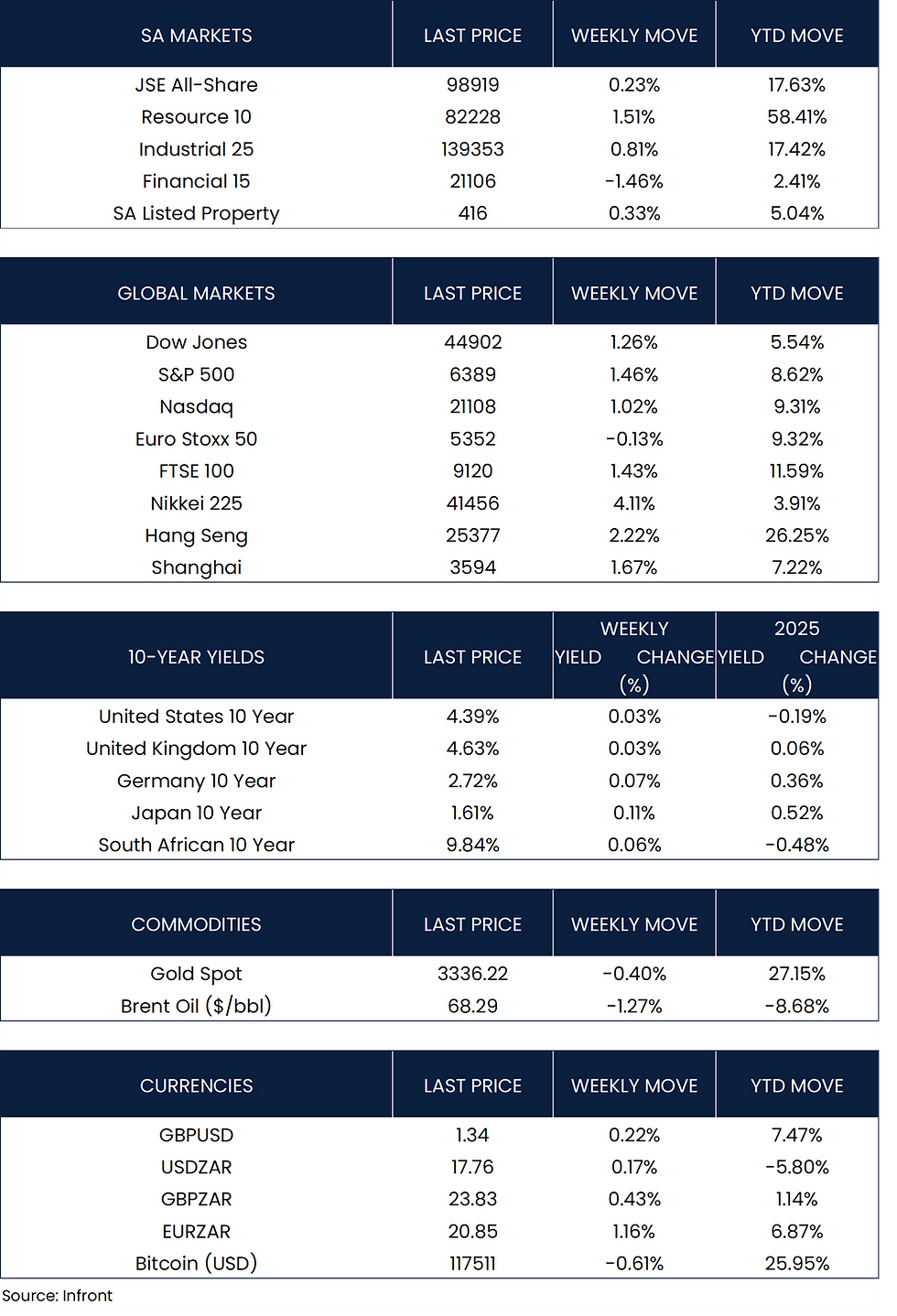

Equity markets broadly advanced as trade developments helped lift investor sentiment. In the U.S., the S&P 500 (+1.46%) and Nasdaq (+1.02%) recorded fresh all-time highs for the second consecutive week, while the Dow rose 1.26%, supported by announcements of new trade deals with Japan, Indonesia, and the Philippines.

Asian markets posted strong gains. Japan’s Nikkei 225 rallied 4.11%, buoyed by news of a trade agreement with the U.S., which helped offset concerns around political uncertainty following the ruling coalition’s loss of its upper house majority. Chinese equities also advanced, with the Shanghai Composite up 1.67% and the Hang Seng climbing 2.22%, as markets looked ahead to another round of U.S.-China trade talks.

Inflation Ticks Up as Diplomatic Tensions Rise

Statistics South Africa (Stats SA) reported on Wednesday that annual consumer price inflation rose to 3.0% in June, up from 2.8% in May, ending two months of stability. The consumer price index (CPI) increased 0.3% month-on-month, with food and non-alcoholic beverages recording their highest annual inflation in over a year. Core inflation, which excludes volatile items like food, fuel, and energy, eased slightly to 2.9% from 3.0%. This data precedes the South African Reserve Bank’s Monetary Policy Committee meeting on 31 July, where a potential rate cut remains under consideration.

Meanwhile, the U.S. House Foreign Affairs Committee advanced the "U.S.–South Africa Bilateral Relations Review Act," which could sanction South African officials over concerns about the country’s foreign policy, including ties with China and Russia. President Cyril Ramaphosa acknowledged the bill, expressing hope for diplomacy to prevail and stating that it will not change South Africa’s approach to its relationship with the United States.

The JSE All Share Index rose modestly by 0.23% over last week, buoyed primarily by a 1.51% gain in the resources sector. Industrials (+0.81%) and property (+0.33%) also contributed positively, while the financial sector was the sole laggard, slipping 1.46%. By Friday’s close, the rand weakened slightly by 0.17% against the U.S. dollar, trading at R17.76, pressured by a stronger dollar and declining gold prices.

Market Moves of the Week

Chart of the Week

Japan’s inflation has rarely exceeded U.S. CPI over the past four decades, aside from brief spikes caused by sales tax hikes. However, recent data show Japanese inflation surpassing U.S. levels, marking a significant shift in long-term trends.